- The Credit Repair Facebook Ads

- The Ad Itself

- The Targeting

- What We Optimized for Credit Repair Facebook Ads

- The Placement

- The Facebook Ad Budget

- The Follow Up

- The Results

- Pro-Tips

- Conclusion

- Does Facebook allow credit repair ads?

- Are Facebook Ads Effective For Credit Repair Leads?

- Are credit repair leads expensive on Facebook?

- Is It Hard To Launch Facebook Ads For Credit Repair?

We Spent $2,000 on Credit Repair Facebook Ads and Generated $15,620 in initial fees for November 2023. Here’s how.

The Credit Repair Facebook Ads

I’m updating this article since writing it in 2019. Since then, Facebook has gone through drastic changes and how it affects your credit repair ads.

It is now more challenging to track how your lead generation ads perform after the changes to iOS 15, cookies, website visit, and tracking.

Don’t worry, Facebook ads still work incredibly for credit repair leads for your service.

Whatever you do, don’t simply boost your post.

We simply have to adjust our strategy.

Mark our word, this is highly achievable still.

This video below walks you through quickly, what I am now doing to generate cheap leads and leverage software automation to nearly put my lead prospecting on autopilot.

Further down this article, I will walk you through step-by-step on what I’ve been doing to successfully generate credit repair leads with Facebook ads.

Note – You’re going to want to be using HighLevel CRM to achieve this level of automation.

The Ad Itself

You’ll want to test 3 different ad types of content you create.

Videos

Graphics

Testimonial

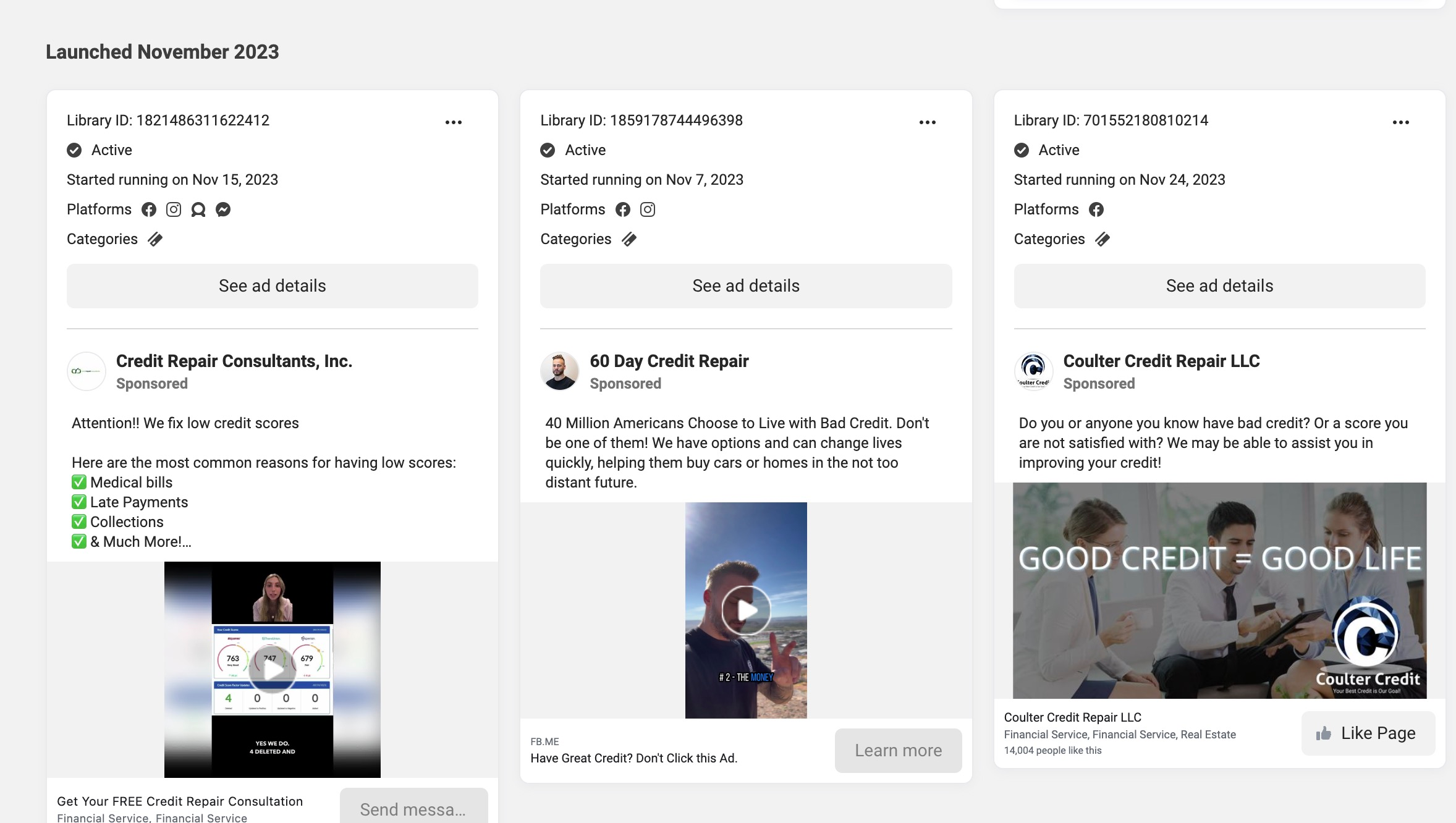

Here are some examples:

You can easily see what other people are using as ads for credit repair using the Facebook Ad Library.

The Targeting

Targeting for Facebook ads post iOS 15 has veered back to interest based.

You could try broad (hardly any targeting).

You’re going to have to test and see which works best for you.

I’ve been seeing more and more ads NOT need the Special Ad Category.

You may have to submit a review if they “reject” the ad because it needs to be a “special ad category”.

But I am seeing more and more ads approved after being reviewed.

Be sure to give yourself up to a week for the ads to be approved.

Below is a look at the interests that I like to target.

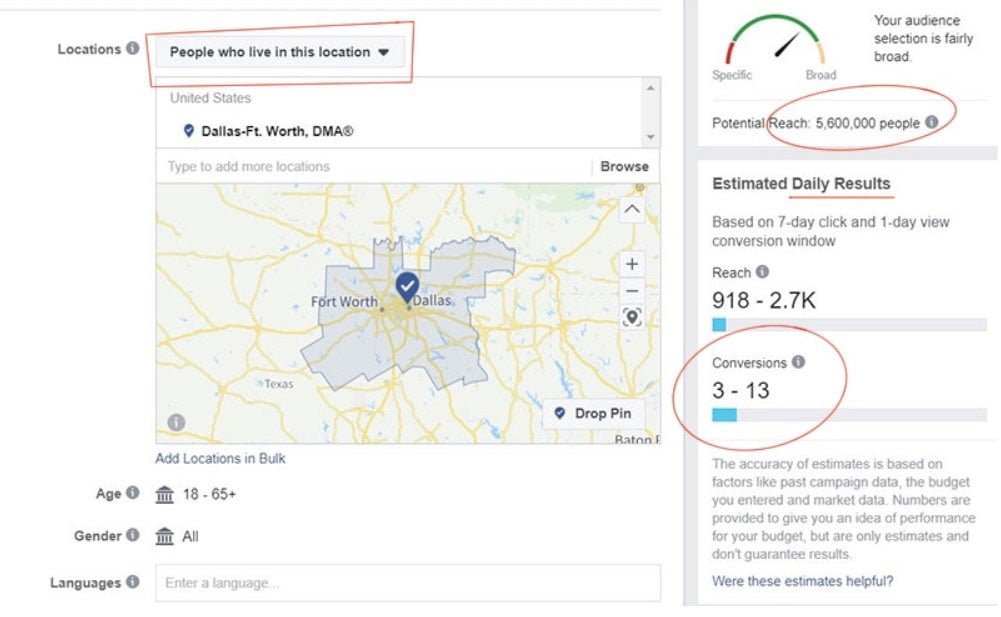

Also choose your location to target.

For a small budget I recommend sticking to your city or state.

Note that Facebook often changes targetable interests, and the available interests can be removed at any time.

Bad Credit

Credit (finance)

Credit history

Financial services

Line of credit

New House

Pre-qualification (lending)

Starter home.

Credit cards (credit & lending)

Mortgage loans (banking)

Personal finance

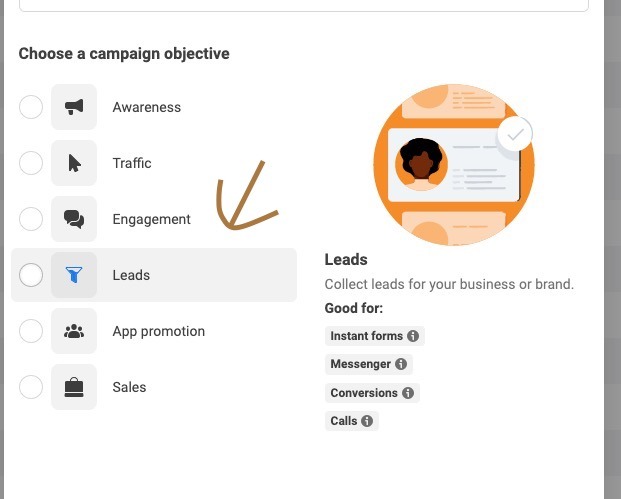

What We Optimized for Credit Repair Facebook Ads

Landing pages are gone for us. Done. Dead.

In my professional opinion, Facebook cannot accurately track what happens outside of their app correctly.

Tracking conversions via a cookie or consent inside of a web browser on someone’s device is challenging after the privacy update.

This in turn means, they are challenged with optimizing for conversions on your website.

Instead, we use Facebook Lead Ads and Instant Forms.

We’ll cover the form itself a little later on in this article.

The Placement

Exclude everything except Facebook Feed and Instagram Feed.

UNCHECK Audience Network (this will get you terrible results).

The Facebook Ad Budget

This client’s Facebook ad budget currently sits at $30 per day.

This doesn’t mean you need to set a similar budget.

Choose whatever best fits your current goals.

You can choose to be more aggressive or less.

Facebook Lead Ad Form Tips

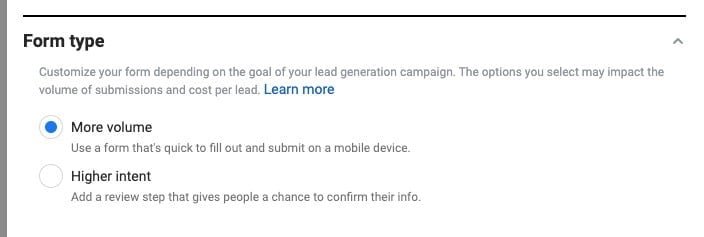

Name your form and then pick the type of form you want.

I prefer Higher Intent, which theoretically leads to a higher quality lead.

The lead has to confirm their info and then swipe to submit vs a simple submit.

The choice is yours.

We start off our form with a professional image that you can draft up in Canva.

The dimensions are 1200 x 628.

Then we ask a simple question: “What’s your goal?”

Be careful with the questions you ask; you cannot ask for info that’s pre-filled by Facebook or ask any questions that Facebook deems inappropriate.

Then we ask for basic contact information.

Here’s the key…

Ask them to take another action after submitting the form.

I enjoy sending them to a survey that qualifies the lead and then allows qualified leads to book an appointment online.

Any leads that do not complete the survey get placed into an SMS/Email Automation/Qualification campaign that drives appointments.

The Follow Up

We used HighLevel software which allows automated, conditional sms/email conversations with prospects automatically.

We watch the inbox for one-off issues and tweak the conversation automation as needed based on comments from the leads.

By the way, I give 100% of this training for FREE when you sign up for HighLevel CRM.

HighLevel also has lots of general training for all industries.

The Results

Let’s check how we ended up, what did we learn and how we can improve.

We generated 326 credit repair leads for our client and they enrolled 50 new customers with an average setup fee of $312.46.

Which generated over $15,620 in immediate revenue.

Our client’s model is PPD so we will also be generating future revenue from these enrollments.

Their average client value is roughly around $1,200 per client.

Therefore, this client could potentially net $60,000 from November’s enrollments.

Not bad for a $2,000 ad spend.

Pro-Tips

Solidify your sales process.

Have a script ready.

Consistent follow-up is crucial to ensure a positive ROI.

Sometimes it takes 5-7 outbound calls over a 1–3-week period to consult a lead and give your sales team the ability to close that business.

Protect your account, never fall for scams via Facebook messenger DMs about your profile page.

DISCLAIMER: Please be sure your business is in compliance with the Telemarketing Sales Rule when selling your credit repair services to customers. We encourage you to seek counsel from a licensed business attorney in your state.

Conclusion

Facebook ads for credit repair companies can prove to be profitable and an excellent addition to any marketing plan.

It is important to ensure that you consider how many leads your organization can handle as you can get more credit repair leads from Facebook for under $5 each on average.

Also, it is important to understand the differences in lead quality.

Referral leads should always be a credit repair company’s priority.

Develop sound relationships with realtors, loan officers, and other complimenting professionals.

These leads typically are free and will close at a much higher percentage.

Internet/Facebook leads will usually close at a lower percentage (5%-20%) depending on your sales process.

In our experience, clients with a sound sales and follow-up process can achieve closer to 20% closing percentage.

In other words, they will close 20 out of 100 leads.

When you consider the ROI, many companies enjoy investing in Facebook ads for their organizations.