Understanding and managing your credit report is essential for anyone looking to secure financial stability and access favorable loan terms. A well-maintained credit report can significantly influence your financial opportunities, affecting everything from the approval process for loans to the interest rates offered by lenders.

It serves as a reflection of your financial reliability and habits, which creditors and financial institutions scrutinize closely. By staying informed and proactive about your credit status, you can ensure you’re positioned to capitalize on financial opportunities and avoid the pitfalls of high interest rates and loan rejections.

Understanding Credit Reports

What is a Credit Report and Why is it Important?

A credit report is a comprehensive document that details an individual’s credit history, compiled by credit reporting agencies. It includes information on credit accounts such as loans, credit cards, and other financial data. This report reflects your financial behavior and compliance with credit agreements, providing a snapshot of your financial stability and creditworthiness.

Credit reports are crucial because they influence your credit score—a numerical expression derived from the analysis of your credit files. This score is used by lenders to determine your eligibility for loans and credit, affecting the terms and interest rates you receive. A high credit score can open the door to better financial products, while a low score can restrict access and result in higher costs.

How to Obtain a Copy of Your Credit Report?

You are entitled to a free copy of your credit report every year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. To obtain your report, visit AnnualCreditReport.com, the only federally authorized website for free credit reports.

Through this site, you can request your reports from each bureau simultaneously or stagger your requests throughout the year. Regularly reviewing your credit report allows you to monitor and correct any inaccuracies, ensuring that your financial records are up-to-date and reflect your credit situation accurately.

This practice is essential for maintaining good credit health and ensuring that your credit report is free from errors that could adversely affect your financial opportunities.

Identifying Credit Report Errors

Common Credit Report Errors to Look Out For

Credit reports can sometimes contain errors that may negatively impact your credit score. Common mistakes include inaccurate information, such as wrong account details; outdated information, like debts that have already been paid or surpassed the reporting period; and duplicate entries, where the same debt is listed more than once. These errors can skew your credit score, potentially leading to unfavorable loan conditions.

How Credit Report Errors Occur?

Errors on credit reports can arise from various sources. Identity theft often leads to erroneous entries as thieves may open accounts in your name. Creditor reporting mistakes can occur if a lender incorrectly reports your payment history or account status.

Additionally, credit bureaus themselves might make errors in compiling data from different sources, leading to discrepancies in your credit report.

Impact of Errors on Your Credit Report

Inaccuracies in your credit report can lead to a lower credit score, which is a key determinant in lending decisions. A reduced score can restrict your ability to secure loans and may result in higher interest rates and less favorable terms. This emphasizes the importance of regularly checking your credit report for any potential errors and addressing them promptly.

Disputing Credit Report Errors

How to Dispute Credit Report Errors with a Credit Bureau?

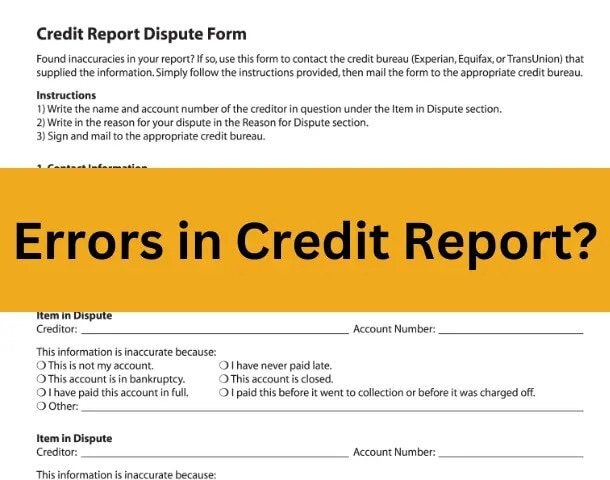

To dispute errors on your credit report, initiate a formal dispute with the credit bureau that issued the report. Begin by writing a detailed dispute letter that clearly identifies the errors and states why the information is incorrect.

Attach copies of documents that support your position. Send this information via certified mail, and request a return receipt to ensure it has been received. The credit bureau is legally obligated to investigate the dispute within 30 days.

Gathering Documentation and Evidence for Your Dispute

Effective documentation is crucial when disputing credit report errors. Gather all relevant documents such as payment records, court documents, or written agreements that can prove your claim. Ensure that you include any evidence that directly contradicts the error in question, such as statements from your creditor showing an account status that differs from what is reported.

Tips for Organizing Your Dispute Materials

Organizing your dispute materials effectively can increase your chances of resolving credit report errors favorably. Create a comprehensive file including copies of your credit report, your dispute letter, and all corresponding documents.

Maintain a detailed record of all communications with the credit bureau, including dates and outcomes of conversations. This organized approach not only helps in tracking the progress of your dispute but also strengthens your case by providing clear and structured evidence.

Understanding the Roles of Credit Reporting Companies

Credit reporting companies play a crucial role in the financial ecosystem by collecting and maintaining individuals’ credit activities. Understanding how these companies operate, and the factors that influence credit scores, is essential for personal financial management.

These companies, including the three major credit bureaus—Equifax, Experian, and TransUnion—provide the foundational data that helps determine your creditworthiness.

Strategies for Resolving Equifax and Experian Credit Report Errors

Errors specific to credit reports from Equifax and Experian can affect various aspects of your financial life. If you spot an error related to these bureaus, detailed documentation and prompt dispute submission are crucial.

Knowing how to navigate their specific dispute processes efficiently can lead to quicker resolutions, helping maintain your credit score and ensuring your financial profile is accurately represented.

Resolving Disputes

If the Credit Bureau Agrees It’s an Error

If the investigation concludes that your dispute is valid, the credit bureau will remove the erroneous information from your credit report. This update is usually completed within 30 days of the decision.

You will receive a free, updated copy of your credit report, which will no longer reflect the incorrect information. It’s crucial to review the updated report to ensure that all corrections have been made appropriately.

If the Credit Bureau Disagrees

Should the credit bureau maintain that the disputed information is accurate, you can take further steps to contest their decision. Resubmit your dispute with additional evidence if available, and clearly articulate why the information is incorrect.

If repeated disputes do not resolve the issue, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) or consult a legal professional for further assistance. The CFPB can provide additional resources and, in some cases, intervene to help resolve the dispute.

Maintaining Credit Report Accuracy

How to Keep Your Credit Report (and Identity) Safe?

Regular monitoring of your credit reports is crucial in maintaining financial security. Utilize identity theft protection services that alert you to potential fraud and unauthorized activities on your accounts.

Additionally, keep your personal information secure by using strong, unique passwords for your financial accounts and being cautious about sharing sensitive information online, especially on unsecured or unfamiliar websites. These preventive measures help safeguard your credit score and overall financial health.

Navigating Your Free Credit Report: Ensuring Accuracy and Integrity

Understanding your credit report is crucial to personal finance management. Every consumer is entitled to a free annual credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion.

This accessibility helps you monitor your financial status, ensuring that your credit activity and history are accurately reported. Regular reviews of your free credit reports enable you to identify any discrepancies or errors that could affect your financial opportunities.

Dispute Credit Report Errors Effectively

When you find inaccuracies in your credit report, it’s essential to take immediate action. Disputing credit report errors is your right, and it’s vital for maintaining your credit health. Each credit bureau has its own process for resolving disputes, but all require detailed documentation and clear evidence when you submit a dispute.

Errors can range from minor details like misspellings of your name to major errors such as incorrect account statuses or fraudulent activities due to identity theft.

How Credit Bureaus Handle Disputes?

The role of credit bureaus in maintaining your credit report is significant. When a dispute is filed, the credit reporting agency must investigate the issue within 30 days. This involves verifying the accuracy of the information with the credit reporting company or the original information provider, such as a credit card company or a loan issuer. Ensuring that these entities correct any errors is crucial for your credit score.

Preventing Identity Theft: A Key to Protecting Your Credit

Identity theft can have a devastating impact on your credit report and scores. Monitoring your credit files for unexpected changes can alert you to potential fraud. It’s important to report and dispute any unauthorized activities immediately to avoid long-term damage. The credit bureaus also offer services such as credit freezes or fraud alerts which can further protect your financial identity from thieves.

Planning for Future Credit Reports

Maintaining a clean credit report isn’t just about correcting past errors—it’s also about planning for the future. Understanding how actions like timely payments, wise credit utilization, and cautious credit applications impact your report can help you make better financial decisions.

These proactive steps are beneficial in ensuring that future credit reports reflect your true creditworthiness, enabling better financial planning and access to favorable credit terms.

The Significance of Monitoring Your Credit Reports

Every consumer is entitled to one free credit report annually from each of the three credit bureaus. It’s vital to take advantage of this provision to check for any inaccurate or incomplete information that might affect your credit score. Regular monitoring helps you identify and address discrepancies such as late payments or unauthorized accounts, ensuring your financial profile remains accurate and up-to-date.