Effective pricing strategies for credit repair services are crucial for both businesses and consumers. These strategies ensure that credit repair companies remain competitive while providing valuable services to clients. By understanding and implementing optimal pricing models, companies can attract more clients and maintain profitability.

Consumers, on the other hand, benefit from transparent and fair pricing, allowing them to make informed decisions about improving their credit scores. Therefore, mastering pricing strategies for credit repair services is essential for achieving a balanced and mutually beneficial relationship between credit repair companies and their clients.

Different Pricing Strategies

Monthly Subscription Fees

Most credit repair companies charge a monthly subscription fee, typically ranging from $50 to $150. This fee covers the cost of ongoing services such as credit report analysis, dispute filing, and continuous monitoring of the client’s credit status. Monthly fees provide a steady revenue stream for companies while offering clients manageable payment options.

Initial Setup Fees

In addition to monthly fees, some credit repair companies charge an initial setup fee, which can range from $70 to $200. This one-time fee covers the cost of initial credit report analysis and the creation of a tailored action plan to address credit issues. The initial setup fee compensates companies for the intensive work required at the start of the credit repair process, ensuring that clients receive a comprehensive and customized service.

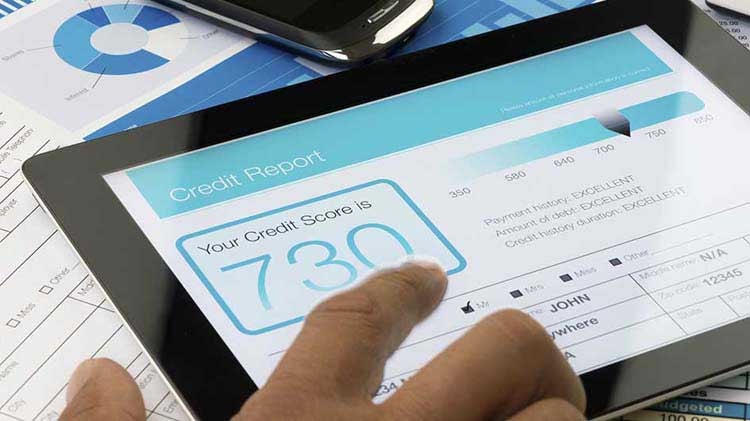

Reviewing and Correcting Your Credit Report

Credit repair companies play a pivotal role in analyzing credit reports to identify errors and inaccuracies that may negatively impact a client’s credit score. By meticulously reviewing credit reports, these companies pinpoint discrepancies such as incorrect account information, outdated records, or fraudulent activities. Correcting these errors is vital for improving credit scores and financial health.

Disputing Errors with Credit Bureaus

Once inaccuracies are identified, credit repair companies dispute these errors with the major credit bureaus—Experian, Equifax, and TransUnion. The dispute process involves submitting detailed documentation and evidence to support the claims.

Credit bureaus are legally required to investigate and respond within 30 days. This structured approach helps ensure that clients’ credit reports are accurate, ultimately leading to better credit scores and improved financial opportunities.

Identifying Errors and Inaccuracies

Credit repair companies play a crucial role in analyzing credit reports to identify errors and inaccuracies. These errors can include incorrect personal information, outdated accounts, and fraudulent activities. Identifying and correcting these inaccuracies is essential for maintaining a healthy credit profile. Accurate credit reports influence your credit score, which impacts your ability to secure loans, mortgages, and other financial services.

Disputing Errors with Credit Bureaus

Once errors are identified, credit repair companies dispute these inaccuracies with the credit bureaus—Experian, Equifax, and TransUnion. The dispute process involves submitting documentation that supports the claim.

Credit bureaus are required to investigate disputes within 30 days. If the dispute is valid, the incorrect information will be corrected or removed, leading to an improved credit score. This step is critical in ensuring that your credit report accurately reflects your financial history.

What to Expect from Credit Repair Services?

Duration of the Process

The credit repair process can take several months to complete. The duration depends on the number of errors found on your credit report and the responsiveness of the credit bureaus. Generally, clients can expect to see progress within three to six months. This timeframe includes the initial analysis, dispute filing, and the investigation period by the credit bureaus.

Filing Dispute Letters

Credit repair companies file dispute letters with the credit reporting agencies to address inaccuracies. Once a dispute is filed, the credit bureaus have 30 days to investigate the claim. During this period, they will verify the information with the data furnisher. If the information cannot be verified, it must be corrected or removed. This systematic approach ensures that your credit report is accurate and up-to-date, which is essential for maintaining a good credit score.

Evaluating Credit Repair Companies

Researching Company’s Track Record

Before selecting a credit repair company, it’s important to research its track record. Check the Consumer Financial Protection Bureau’s (CFPB) Consumer Complaint Database and the Federal Trade Commission (FTC) website for any complaints or actions taken against the company. This research helps ensure you are dealing with a reputable and reliable company that adheres to legal and ethical standards.

Online Reviews and Ratings

In addition to official databases, review the company’s ratings on independent platforms like the Better Business Bureau (BBB) and Trustpilot. These websites provide insights from other customers about their experiences with the company. Look for consistent positive feedback and high ratings, which indicate a trustworthy service provider. Pay attention to any recurring issues or complaints, as these can be red flags about the company’s practices and effectiveness.

Credit Repair Company Regulation

Credit Repair Organizations Act (CROA)

The Credit Repair Organizations Act (CROA) governs all U.S. credit repair companies. This federal law requires credit repair companies to provide clients with a written contract detailing their services and guarantees. It also mandates that companies cannot make false claims about their services or charge upfront fees before rendering services. CROA ensures transparency and protects consumers from fraudulent practices, making it crucial for credit repair companies to comply with these regulations.

Telemarketing Sales Rule

Credit repair companies that solicit business by phone must adhere to the federal Telemarketing Sales Rule. This rule prohibits deceptive and abusive telemarketing practices, ensuring that credit repair companies do not mislead potential clients during phone solicitations.

Compliance with these regulations is essential for maintaining trust and credibility in the credit repair industry. Companies must provide truthful information about their services and respect consumers’ rights to avoid legal repercussions and build a positive reputation.

Pros and Cons of Each Approach

DIY Credit Repair

DIY credit repair is a free option that allows individuals to monitor and improve their credit scores independently. By obtaining free credit reports from the major credit bureaus, consumers can identify and dispute inaccuracies themselves. This approach saves money and gives consumers control over their credit repair process. However, it requires time, effort, and a good understanding of credit laws and dispute processes.

Professional Services

Professional credit repair services offer expertise and convenience. These companies handle the entire process, from analyzing credit reports to filing disputes with the credit bureaus. While they charge fees for their services, the benefits include professional handling of complex issues and faster results.

The associated costs vary, with initial setup fees and monthly subscription fees, but the convenience and potential for improved credit scores can be worth the investment for many consumers.

Understanding the Fine Print

Company’s Cancellation Policy

Before committing to a credit repair service, it is crucial to understand the company’s cancellation policy. This policy should outline the steps to suspend or terminate the service without incurring penalties or additional fees. Being aware of the cancellation terms helps consumers avoid unexpected charges and ensures they can discontinue the service if they are not satisfied with the results.

Money-Back Guarantee

Checking a company’s money-back guarantee policy is essential for ensuring a risk-free commitment. A reputable credit repair company will offer a refund if the promised results are not achieved within a specified timeframe. This guarantee provides consumers with peace of mind, knowing they can receive their money back if the service does not deliver the expected improvements in their credit score.

Researching a Company’s Reputation

Transparency of Services and Fees

A legitimate credit repair company will be transparent about its services and fees. Clear information about the costs and the scope of services provided helps consumers make informed decisions. Transparency also builds trust, as clients know exactly what to expect without hidden charges or misleading claims.

Independent Reviews and Ratings

Sources like the Better Business Bureau (BBB) and Trustpilot offer independent reviews and ratings that can provide valuable insights into a credit repair company’s reputation. Positive reviews and high ratings from these platforms indicate reliable and effective services. Consumers should consider these reviews to gauge the company’s performance and customer satisfaction before making a decision.

Tips and Strategies for Rapid Credit Improvement

Engaging Credit Repair Services

One of the fastest ways to repair your credit is to engage the services of a professional credit repair company. These companies offer complimentary credit consultations and detailed analyses of your credit report. By leveraging their expertise, you can identify and address issues more efficiently, leading to quicker improvements in your credit score.

Understanding Fee Structures

Before committing to a credit repair service, it’s important to understand their fee structures, including monthly fees and initial costs. Some companies offer flexible payment options and packages tailored to your specific needs.

Being informed about the costs upfront ensures that you can budget accordingly and avoid unexpected expenses. Additionally, some companies may offer expedited services for a premium, providing faster results for those in urgent need of credit repair.

Credit Monitoring and Financial Goals

Monitoring your credit is an essential part of maintaining a good credit score and achieving your financial goals. Many credit repair companies offer credit monitoring services to track changes in your credit report and score.

These services can help you stay informed about your credit status and address any issues promptly. Personal finance tools provided by credit repair agencies can assist in managing all your debts, improving payment history, and ensuring you stay on track towards a stable financial future.

Free Credit Reports and Consultations

Consumers are entitled to a free credit report from each of the three major credit bureaus annually. Reviewing these reports can help you identify any inaccuracies affecting your credit score. Many credit repair companies also offer a free consultation to assess your credit situation and provide recommendations for improvement. Utilizing these free resources can be a proactive step in managing your credit effectively.

Moreover, some companies provide additional services such as ID theft insurance and credit counseling, which can further protect and enhance your financial health.

Evaluating Reputable Companies for Prospective Clients

When choosing a credit repair service, it’s crucial for prospective clients to consider reputable companies. These companies typically have a strong track record of delivering reliable and effective services.

Prospective clients should research the company’s history, ensuring it complies with legal standards and has positive feedback from past clients. Engaging with reputable companies ensures that clients receive high-quality assistance in repairing their credit scores.

Understanding Services Offered by Credit Repair Companies

Credit repair companies offer a variety of services to help improve clients’ credit scores. These services often include credit report analysis, error identification, and dispute filing with credit bureaus.

By understanding the range of services offered, clients can select a company that best meets their specific needs. Companies with a comprehensive service offering are better equipped to address a wide range of credit issues, providing more effective solutions for their clients.

Ensuring a Complete Refund Policy

A complete refund policy is a critical aspect to consider when selecting a credit repair company. Reputable companies often provide a complete refund if they fail to deliver the promised results. This policy protects clients’ investments and demonstrates the company’s confidence in its services.

Prospective clients should carefully review the refund policy to ensure they can receive their money back if the service does not meet their expectations, providing financial security and peace of mind.