In the rapidly evolving landscape of financial services, credit repair organizations are continually seeking innovative ways to enhance their operations and deliver superior results to their clients. One strategic approach that has gained prominence is credit repair outsourcing. This method not only streamlines the process of repairing credit but also ensures that organizations can focus on their core competencies while leveraging the expertise of specialized partners.

Through this comprehensive guide, we will explore the myriad advantages it offers, and unveil how it can transform the efficiency and effectiveness of credit repair services.

Understanding Credit Repair Outsourcing

Outsourcing refers to the process where credit repair businesses delegate specific tasks or services to third-party companies or specialists. These tasks often include credit report analysis, dispute management, and customer service operations. The primary aim is to leverage external expertise to enhance service quality, accelerate the credit repair process, and achieve better outcomes for clients. This approach allows credit repair companies to focus on strategic growth and client acquisition by reducing the burden of day-to-day operational tasks.

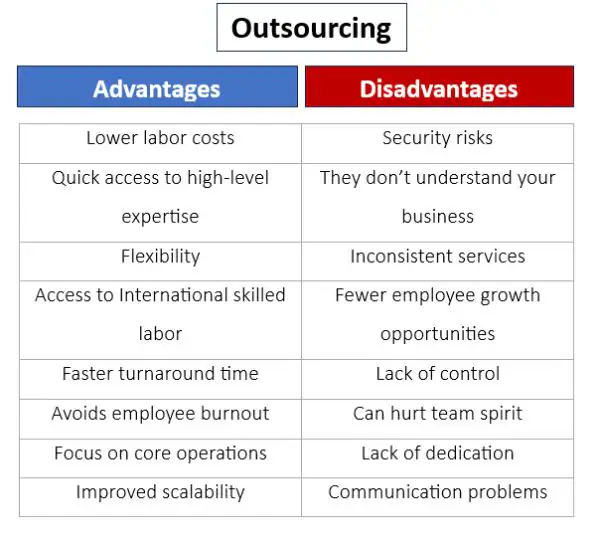

The Advantages of Outsourcing for Credit Repair

Outsourcing in the credit repair sector offers a multitude of benefits, ranging from cost savings to improved operational efficiency. By tapping into the resources and expertise of third-party providers, credit repair businesses can significantly enhance their service offerings and client satisfaction levels.

Cost-Effectiveness and Scalability

One of the most compelling advantages of outsourcing is its cost-effectiveness. Credit repair businesses can save on the expenses associated with hiring full-time staff, such as salaries, training, and benefits. Instead, they can access a scalable workforce that can be adjusted according to business needs, ensuring that they can manage workload peaks without the financial burden of maintaining a large in-house team.

Access to Expertise and Advanced Tools

Outsourcing partners often possess specialized knowledge and access to advanced tools and technology tailored for credit repair services. This expertise enables them to efficiently handle complex disputes, manage credit reports, and maintain compliance with legal standards. Credit repair businesses benefit from high-quality service delivery without the need to invest in expensive software or training programs, ultimately enhancing the overall client experience.

Choosing the Right Credit Repair Virtual Assistant

In the journey towards streamlining operations and maximizing efficiency, selecting the ideal credit repair virtual assistant is crucial. This decision can significantly impact the quality of service offered to clients, affecting everything from dispute handling to customer communications. A proficient virtual assistant (VA) not only brings in expertise in credit repair tasks but also introduces a level of flexibility and efficiency that can transform your business operations.

Skills to Look For

When scouting for a virtual assistant for your credit repair business, prioritize candidates with a strong understanding of the credit repair process, including knowledge of major credit bureaus, credit reports, and dispute letter templates. Proficiency in professional credit repair software, such as Credit Repair Cloud or DisputeBee, is also essential.

Additionally, look for organizational skills, attention to detail, and excellent communication abilities to ensure they can manage client interactions effectively and maintain dispute progress documentation accurately.

Where to Find Professional Assistants

Finding professional virtual assistants with the right mix of skills and experience requires looking in the right places. Platforms dedicated to freelancing and specialized services, such as Upwork and Freelancer, are excellent starting points. These platforms allow you to review the skills, experience, and ratings of potential hires.

Additionally, industry-specific forums and networks, such as those related to credit repair professionals or credit repair business software communities, can be valuable resources for finding VAs who are already familiar with the niche requirements of credit repair services and possess the unique skills your business needs to thrive.

Overview of Professional Credit Repair Software

In the realm of credit repair, leveraging professional software is a game-changer for businesses aiming to enhance efficiency, accuracy, and client satisfaction. These advanced platforms are designed to automate and streamline the complex tasks associated with repairing credit, from importing credit reports to generating dispute letters.

By adopting professional credit repair software, businesses can significantly reduce manual errors, save time, and focus more on strategic growth and client engagement, making it an indispensable tool for success in the competitive credit repair industry.

Key Features and Benefits

Professional credit repair software comes packed with features designed to simplify the credit repair process. Essential functionalities include bulk printing of dispute letters, automated import of credit reports from major credit bureaus, and advanced dispute tracking systems to monitor progress. These tools not only expedite the dispute resolution process but also enhance the accuracy of credit report analysis, ultimately improving the chances of success for clients. The software’s ability to manage multiple client cases efficiently makes it a valuable asset for credit repair businesses looking to scale their operations.

Customization and Integration Capabilities

One of the most compelling aspects of professional credit repair software is its customization and integration capabilities. This flexibility allows businesses to tailor the software’s functionality to meet their specific operational needs and integrate seamlessly with other tools and platforms they use, such as CRM systems, marketing tools, and accounting software.

Customization can range from dispute letter templates to client communication channels, ensuring that the software aligns perfectly with the company’s brand and workflow. Integration capabilities further streamline operations, enabling a more cohesive and efficient approach to managing the credit repair process and enhancing overall business performance.

Software Solutions Deep Dive

Navigating through the plethora of credit repair software options can be daunting. However, understanding the different categories, such as white label solutions, software tailored for small businesses, and the distinction between free and premium versions, can significantly impact your credit repair business’s success and growth.

White Label Credit Repair Software

White label credit repair software allows businesses to offer comprehensive credit repair solutions under their brand. This software type is ideal for those who wish to establish brand presence and offer customized services without the development costs associated with proprietary software.

Benefits of Branding Your Software

Branding your software enhances your company’s professional image and helps in building trust with your clients. It allows for a seamless client experience that aligns with your business’s branding and communication strategies, setting you apart in a competitive market where credibility and brand strength are crucial for attracting and retaining clients.

Top White Label Solutions

Top white label solutions like Credit Repair Cloud and DisputeBee offer robust features for businesses to efficiently process disputes, manage client information, and automate communications, all under their brand name. These platforms are highly regarded for their reliability, user-friendly interfaces, and comprehensive support, making them go-to choices for businesses looking to offer credit repair services with a personal touch.

Credit Repair Software for Small Business

For small businesses, finding the right software is about balancing cost with functionality to support operations and facilitate growth without overwhelming resources.

Affordable and Efficient Solutions

Small businesses should look for credit repair software that offers core functionalities such as dispute management, credit report analysis, and client portal access at an affordable price point. Solutions like DisputeBee and Credit Detailer stand out for their cost-effectiveness and efficiency, catering specifically to the needs of smaller operations.

Managing Business Growth

Choosing software that scales with your business is crucial. As your client base grows, your chosen platform should support increased case loads, offer additional features for efficiency, and enable you to maintain high service quality. Look for software with flexible pricing plans and the capability to add features or users as needed.

Free vs. Premium Software Options

The decision between free and premium credit repair software hinges on your business needs, budget, and long-term goals.

What Free Software Offers

Free credit repair software options typically provide basic functionalities like dispute letter templates and client tracking. These solutions can be a good starting point for new or very small businesses testing the waters of credit repair services without a significant initial investment.

When to Invest in Premium

As your business grows, investing in premium software becomes essential. Premium options offer advanced features such as automated dispute filing, comprehensive analytics, integration capabilities, and superior customer support. For businesses aiming to expand their operations, improve efficiency, and provide a higher level of service, the investment in premium software pays dividends in streamlined processes and improved client outcomes.

Mastering Credit Repair Processes

Achieving excellence in credit repair demands mastery over several critical processes. From analyzing credit reports with precision to managing client communications effectively, each step plays a pivotal role in delivering quality service. Below, we delve into these essential processes, outlining how to optimize each for maximum efficiency and impact.

Efficient Credit Report Analysis

A thorough analysis of credit reports is foundational to identifying inaccuracies and pinpointing dispute opportunities. Leveraging the right tools can significantly streamline this process.

Tools for Importing and Analyzing Reports

Modern credit repair software offers powerful features for importing credit reports directly from the three major credit bureaus. These tools automatically highlight potential inaccuracies and areas for disputes, saving valuable time and reducing the likelihood of human error.

Identifying Key Dispute Areas

Once reports are imported, the focus shifts to identifying key dispute areas. Effective software aids in quickly pinpointing outdated, incorrect, or fraudulent entries. Mastery in this area accelerates the preparation of dispute letters and enhances the success rate of credit repair efforts.

Crafting Effective Dispute Letters

The dispute letter is the heart of any credit repair strategy. Tailoring these letters to each specific case increases their effectiveness.

Template Customization

Utilizing customizable templates within credit repair software allows for rapid generation of dispute letters that are both personal and precise. This customization ensures that each letter addresses the unique issues found in the client’s credit report.

Tracking Dispute Progress

After disputes are filed, tracking their progress is essential. Advanced software solutions provide real-time updates on dispute status, enabling timely follow-ups and adjustments to strategy as needed. This not only keeps the process moving forward but also allows for transparent communication with clients about their case status.

Enhancing Client Communication

To find credit repair clients, focus on building a strong online presence through SEO, engaging on social media, and creating educational content that highlights the benefits of your services. Networking with financial advisors and real estate agents can also introduce you to potential clients in need of improving their credit scores. I

Automated Updates and Reports

Software that offers automated updates and reports keeps clients informed about their case progress without requiring constant manual intervention. This efficiency builds confidence in the service provided and enhances client satisfaction.

Secure Document Handling

Ensuring the security and privacy of client documents is paramount. Credit repair software with robust security features protects sensitive information while facilitating easy access and sharing between the service provider and client.

Business Management Strategies

Managing the business aspect of a credit repair service efficiently can significantly contribute to its success.

Using Software for Billing and Invoicing

Incorporating billing and invoicing functionalities into the credit repair software streamlines financial transactions, reduces administrative overhead, and improves cash flow management.

Advanced Reporting for Business Insights

Access to advanced reporting features enables businesses to analyze performance metrics, identify trends, and make data-driven decisions. This insight is crucial for strategic planning, helping to direct marketing efforts, adjust service offerings, and ultimately drive business growth.

Marketing Your Credit Repair Business

In a competitive landscape, effectively marketing your credit repair business is crucial to attracting new clients and building a reputable brand. Digital marketing strategies and building a strong referral network are fundamental components to growing both new and existing credit repair businesses. By implementing a comprehensive marketing approach, your business can become a profitable and authoritative entity in the credit repair industry.

Digital Marketing Strategies

Digital marketing offers a multifaceted approach to reaching potential clients where they spend a significant amount of their time: online.

Social Media and PPC Advertising

Leveraging social media platforms and Pay-Per-Click (PPC) advertising can amplify your reach and engagement with potential clients. Utilizing ads that highlight your all-in-one solution for dealing with late payments, negative items, and unlimited disputes can attract individuals looking to improve their credit scores. Exclusive features of your software platform should be emphasized to differentiate your services from other software options.

Building a Referral Network

A strong referral network can significantly enhance your business’s ability to attract and retain clients through trusted recommendations.

Partnering with Financial Advisors

Establishing partnerships with financial advisors can open a gateway to a steady stream of referrals, especially from clients with specific needs around managing medical debt or requiring credit audits. This collaboration benefits both parties and offers a direct link to potential clients who trust their advisor’s recommendations.

Affiliate Programs

Creating an affiliate program can incentivize other businesses or individuals to refer clients to your credit repair business. By offering rewards for referrals that result in new clients, you can tap into the networks of related financial services, extending your reach and potentially increasing your client base. This strategy not only expands your visibility but also establishes your brand as a profitable credit repair business that is serious about providing value to both its clients and partners.

Competitive Edge: Learning from the Best

To establish a dominant position in the credit repair industry, it’s essential to understand what sets the leading companies apart. Analyzing top competitors and their innovative offerings provides valuable insights that can be leveraged to enhance your own credit repair business.

Analyzing Top Competitors

The best credit repair businesses distinguish themselves through exceptional service, comprehensive solutions, and a strong online presence. They often utilize advanced credit repair training and software platforms that offer exclusive features, making the dispute process incredibly easy for both their staff and clients.

By examining these businesses, you can identify key areas for improvement in your own operations, such as enhancing your website’s SEO, offering more personalized credit audits, or simplifying the dispute letter process.

Innovative Features and Offerings

Leading credit repair companies continuously innovate, offering new features and services that address specific client needs, such as handling medical debt or providing tools for managing late payments and negative items. These innovations may include all-in-one solutions that streamline the credit repair process, software that supports unlimited disputes, or platforms that make tracking dispute progress easy. Integrating similar features into your services can significantly improve client satisfaction and operational efficiency.

Preparing for the Future of Credit Repair

As technology evolves, so does the credit repair industry. Staying ahead requires an ongoing commitment to innovation and learning.

Upcoming Trends in Credit Repair Technology

Emerging technologies like artificial intelligence and blockchain are set to revolutionize the way credit repair services are delivered. These advancements promise to enhance data security, improve dispute accuracy, and automate repetitive tasks, making the credit repair process faster and more efficient.

Staying Ahead: Continuous Learning and Adaptation

To remain competitive, embracing continuous learning and adaptation is crucial. This means regularly updating your knowledge of credit repair regulations, adopting new technologies, and refining your marketing strategies. By doing so, you ensure that your credit repair business not only meets the current needs of your clients but is also well-positioned to adapt to future challenges and opportunities.