The credit repair industry plays a crucial role in helping individuals improve their credit scores and overall financial health. As a credit repair business owner, you’ll be addressing inaccuracies on credit reports, negotiating with creditors, and providing clients with actionable advice to enhance their credit profiles.

The industry is regulated by federal laws, such as the Credit Repair Organizations Act, which ensures that businesses operate ethically and transparently. With the rising awareness of credit scores’ importance in securing loans, mortgages, and even employment, the demand for reliable credit repair services has grown significantly. Successful credit repair businesses not only assist clients in disputing errors but also educate them on maintaining good credit habits, making it a vital sector in the financial services industry.

Understanding the Requirements of a Credit Repair Business

What a Credit Repair Business Requires?

Starting a credit repair business requires a thorough understanding of industry regulations and obtaining the necessary certifications and licenses. First, ensure compliance with the Credit Repair Organizations Act (CROA) to operate legally and ethically. Acquiring a business license is essential to establish your business as a legitimate entity.

Additionally, obtaining credit repair certification can enhance your credibility and demonstrate your expertise to potential customers. Invest in quality credit repair software to streamline operations and efficiently manage client information. Hiring a skilled credit repair specialist can also enhance your service quality and client satisfaction.

By understanding and fulfilling these requirements, you can build a strong foundation for your credit repair business, attract more clients, and differentiate yourself from other credit repair companies in the market.

How Credit Repair Companies Work to Improve Credit Scores?

Credit repair companies work by employing knowledgeable credit repair specialists who analyze clients’ credit reports, identify inaccuracies, and dispute errors with credit bureaus. These specialists are trained to navigate the complexities of credit reporting and employ effective strategies to improve clients’ credit scores. They often collaborate with clients to gather necessary documentation and provide guidance on maintaining good credit practices.

Additionally, reputable credit repair companies ensure that their staff holds relevant certifications, reinforcing their expertise and commitment to ethical practices. Understanding the intricate processes involved and the importance of hiring qualified specialists can help you establish a successful credit repair business.

By demonstrating your team’s proficiency and dedication to customer service, you can attract potential customers and stand out among other credit repair companies in the industry.

Importance of Attracting the First 50 Clients

Attracting your first 50 clients in the credit repair business is a pivotal milestone that sets the foundation for future growth and success. These initial clients help establish your business reputation, provide valuable testimonials and referrals, and generate the recurring revenue needed to sustain and expand your operations.

To achieve this, it’s essential to implement effective credit repair marketing strategies, leverage social media platforms, and utilize digital marketing tools to reach your target audience. Building a strong online presence and ensuring your website’s visibility on search engines like Google will drive traffic and attract potential clients.

By focusing on delivering high-quality services and maintaining a consistent social media presence, you can successfully attract your first 50 clients and build a robust credit repair organization.

Understanding Your Target Market

Identifying Potential Clients

Identifying potential clients is the first step to building a successful credit repair business. Your target audience typically includes individuals with poor credit scores, those who have been denied loans, and people facing financial hardships due to inaccurate information on their credit reports.

Small business owners and entrepreneurs who require good credit for business financing also fall within this demographic. To effectively attract these clients, it’s essential to understand their specific needs and pain points. Focus on clients seeking credit repair services to improve their credit scores for purchasing homes, cars, or securing better interest rates on loans.

Additionally, individuals recovering from financial setbacks, such as bankruptcy or divorce, often seek credit repair solutions. By targeting these groups through precise marketing strategies, including social media platforms, paid advertising, and educational content, you can reach a broader audience and generate quality leads.

Utilizing tools like Google Analytics and search engines to track website traffic and user behavior will further refine your approach, ensuring your marketing efforts are directed toward those most likely to benefit from your services.

Analyzing the Credit Repair Market

Analyzing the credit repair market involves understanding the competitive landscape and identifying trends that can influence your business strategy. The credit repair industry is highly competitive, with numerous businesses offering similar services.

To stand out, you need to differentiate your credit repair company by highlighting your unique selling proposition (USP). This could be personalized service, a success-based pricing structure, or advanced credit repair software that streamlines the dispute process. Stay informed about industry trends, such as the increasing use of digital marketing strategies and social media channels to reach potential clients.

The rise of credit repair cloud services and software solutions has also transformed how businesses operate, offering more efficient ways to manage client information and improve service delivery. Understanding federal laws, such as the Credit Repair Organizations Act, ensures compliance and builds trust with clients.

By conducting a thorough market analysis, you can identify opportunities to expand your services and tap into underserved segments. This proactive approach not only attracts new clients but also positions your business as a knowledgeable and reliable player in the credit repair industry. Leveraging insights from competitors and staying updated on industry developments will help you create a robust business plan that supports long-term growth and success.

Creating a Business Plan

Setting Business Goals

Setting clear and achievable business goals is essential for the success of your credit repair business. Begin by identifying short-term and long-term objectives. Short-term goals might include attracting your first 50 clients within six months, establishing a consistent social media presence, and generating quality leads through effective credit repair marketing strategies.

Long-term goals could involve expanding your services to include credit counseling, achieving a specific revenue target, or opening additional office spaces in different locations. Ensure your goals are specific, measurable, attainable, relevant, and time-bound (SMART) to provide a clear roadmap for your business growth. Regularly review and adjust these goals based on your business’s performance and market changes.

Budgeting for Marketing and Operations

A well-planned budget is crucial for managing marketing efforts and daily operations. Allocate funds for various marketing tactics, such as paid advertising on social media platforms, direct mail campaigns, and email marketing. Consider investing in credit repair software and digital marketing tools to streamline processes and enhance your business’s efficiency.

Your budget should also cover overhead costs like office space, utilities, and employee salaries. It’s important to monitor your spending and adjust as necessary to ensure that your marketing strategies remain cost-effective. By carefully planning your budget, you can maximize your return on investment (ROI) and ensure the sustainability of your credit repair business.

Developing a Pricing Structure

Developing a competitive and transparent pricing structure is vital for attracting clients and building trust. Research your competitors’ pricing models to determine standard rates within the credit repair industry. Consider offering a flat fee or success-based pricing to appeal to potential clients.

Your pricing should reflect the value of your services, including credit report reviews, dispute letter preparation, and continuous support. Ensure your pricing is clear and upfront to avoid misunderstandings and build credibility. Additionally, consider offering tiered pricing packages that cater to different client needs and budgets, providing flexibility and attracting a broader audience.

Ensuring Compliance with Federal Laws

Compliance with federal laws, such as the Credit Repair Organizations Act (CROA), is critical for the legitimacy and success of your credit repair business. The CROA mandates specific requirements for credit repair companies, including providing clients with a written contract that outlines their rights and the services you will perform. You must also inform clients of their right to cancel the contract within three business days.

Ensuring compliance involves staying updated on any changes in federal laws and implementing practices that meet legal standards. This not only protects your business from legal repercussions but also builds trust with clients, demonstrating your commitment to ethical practices. Regularly training your staff on compliance issues and maintaining transparent communication with clients about their rights will further enhance your business’s reputation and reliability.

Building an Online Presence

Importance of a Professional Website

A professional website is the cornerstone of your online presence and a critical tool for attracting clients to your credit repair business. It serves as the first point of contact for potential clients, providing them with essential information about your services, expertise, and business values.

A well-designed website should be user-friendly, visually appealing, and mobile-responsive to ensure a seamless experience for visitors on all devices. Include detailed information about your credit repair process, client testimonials, and an easy-to-navigate menu.

Your website should also feature clear calls-to-action (CTAs) to guide visitors toward scheduling consultations, signing up for newsletters, or contacting your business directly. Offering educational resources, such as blogs and videos, can help establish your authority in the credit repair industry and build trust with potential clients.

Investing in a professional website not only enhances your credibility but also improves your business’s visibility and accessibility, ultimately driving more traffic and generating quality leads.

Optimizing Your Website for Search Engines (SEO)

Search engine optimization (SEO) is essential for increasing your website’s visibility on search engines like Google, helping potential clients find your credit repair services.

Ensure your website is technically optimized by improving page load speeds, using secure HTTPS encryption, and creating a mobile-friendly design. Developing high-quality, informative content that addresses common credit repair questions and concerns can attract organic traffic and establish your site as a valuable resource.

Additionally, building backlinks from reputable websites can enhance your site’s authority and improve its ranking in search engine results. Regularly updating your content and monitoring SEO performance will help maintain your website’s visibility and attract more potential clients.

Utilizing Google Analytics for Website Traffic Insights

Google Analytics is a powerful tool that provides valuable insights into your website’s performance and user behavior. By tracking various metrics, you can understand how visitors interact with your site, identify popular content, and assess the effectiveness of your marketing strategies. Key metrics to monitor include page views, average session duration, bounce rate, and conversion rates.

Use Google Analytics to identify the sources of your website traffic, such as organic search, social media platforms, or direct visits. This information helps you determine which marketing channels are most effective and where to focus your efforts.

Analyzing user behavior, such as the pages they visit and the actions they take, can provide insights into potential areas for improvement on your site. By leveraging these insights, you can optimize your website’s content and structure to better meet the needs of your audience, enhance user experience, and ultimately attract more clients to your credit repair business.

Social Media Marketing

Choosing the Right Social Media Platforms

Choosing the right social media platforms is crucial for effectively reaching your target audience and promoting your credit repair business. Focus on platforms where your potential clients are most active. Facebook is a top choice due to its large user base and advanced advertising options, making it ideal for targeted credit repair marketing strategies.

LinkedIn is beneficial for connecting with professionals and small business owners who may need credit repair services. Instagram can help you reach a younger demographic with visually appealing content, while Twitter is useful for sharing quick updates and engaging with industry trends. By selecting the platforms that align with your audience’s preferences and behavior, you can maximize your reach and impact.

Creating Consistent Social Media Content

Creating consistent social media content is essential for building a strong online presence and keeping your audience engaged. Start by developing a content calendar that outlines your posting schedule and ensures a regular flow of updates. Share a mix of content types, including educational articles, client testimonials, success stories, and tips on maintaining good credit scores. Use eye-catching visuals, such as infographics and videos, to make your posts more engaging.

Incorporate relevant keywords and hashtags to increase your content’s visibility and reach a broader audience. Highlight your unique selling propositions, such as personalized service and effective credit repair solutions, to differentiate your business from competitors. Regularly update your followers on industry news, changes in credit repair laws, and new services you offer.

By maintaining a consistent posting schedule and providing valuable content, you can establish your credit repair business as a trusted authority in the industry and attract more potential clients.

Engaging with Your Audience on Social Media

Engaging with your audience on social media is key to building relationships and fostering trust with potential clients. Respond promptly to comments, messages, and inquiries to show that you value your audience’s input and are available to assist them. Host live Q&A sessions or webinars on platforms like Facebook Live or Instagram Live to address common credit repair questions and provide real-time advice.

Encourage your followers to share their experiences and success stories by creating user-generated content campaigns. This not only provides social proof but also increases your reach as followers share their positive experiences with their networks. Conduct polls, surveys, and contests to boost engagement and gather insights into your audience’s preferences and needs.

By actively participating in conversations, addressing concerns, and celebrating client successes, you can create a loyal community around your brand. This approach not only helps in retaining current clients but also attracts new ones through word-of-mouth referrals and positive online interactions.

Content Marketing Strategies

Developing Educational Resources

Developing educational resources is essential for establishing your credit repair business as a trusted authority in the industry. Providing valuable information helps potential clients understand the importance of credit repair and the steps involved in improving their credit scores.

Additionally, develop infographics that visually explain complex credit repair processes, making the information accessible and engaging. Host live Q&A sessions on social media platforms or conduct workshops to address common credit repair questions.

By consistently offering high-quality educational content, you attract potential clients and provide them with the knowledge they need to make informed decisions about their financial health, enhancing your reputation as a reliable expert in credit repair.

Blogging and SEO

Blogging is a powerful tool for improving your website’s visibility and attracting potential clients through search engines. Write informative and engaging blog posts that address common questions and challenges related to credit repair. Consistently publishing high-quality, optimized content will help improve your website’s ranking on search engines like Google, driving organic traffic to your site.

Additionally, include internal and external links within your blog posts to boost SEO and provide readers with additional valuable resources. Regular blogging not only helps attract potential clients but also positions your credit repair business as a knowledgeable and reliable resource in the industry.

Using Videos and Webinars to Attract Clients

Using videos and webinars is an effective way to engage your audience and attract new clients to your credit repair business. Videos can simplify complex credit repair concepts, making them more accessible to a broader audience.

Webinars offer an interactive platform to provide in-depth information and answer real-time questions from potential clients. Collect attendee information during the registration process to build your email list and follow up with personalized offers or consultations.

Both videos and webinars help demonstrate your expertise, build trust with your audience, and provide valuable insights into credit repair. By leveraging these engaging content formats, you can attract more potential clients, enhance your online presence, and establish your credit repair business as a leader in the industry.

Email Marketing

Building an Email List

Building an email list is crucial for maintaining direct communication with potential clients and nurturing leads in your credit repair business. Start by offering valuable incentives to encourage visitors to subscribe to your email list. These incentives can include free e-books, guides on improving credit scores, or exclusive access to webinars. Ensure that your website has clear and compelling calls-to-action (CTAs) for newsletter sign-ups. Use pop-ups, landing pages, and opt-in forms strategically placed on high-traffic pages to capture visitor information.

Additionally, promote your email list through social media platforms and at industry events to expand your reach. By providing valuable content and maintaining a strong online presence, you can grow your email list with engaged and interested potential clients.

Crafting Effective Email Campaigns

Crafting effective email campaigns is essential for converting subscribers into clients. Start by segmenting your email list based on criteria such as client needs, engagement level, and demographic information to ensure your messages are relevant and personalized.

Develop a series of automated email sequences that guide subscribers through the credit repair process, from initial interest to scheduling a consultation. Each email should have a clear purpose, whether it’s educating about the credit repair process, sharing success stories, or offering special promotions.

Use attention-grabbing subject lines to increase open rates and include compelling content that provides value to the reader. Incorporate client testimonials, tips for improving credit scores, and updates on new services. Ensure your emails are mobile-friendly and visually appealing, with a clear call-to-action (CTA) that directs readers to your website or contact form.

By delivering timely and relevant content, you can build trust with your subscribers and encourage them to take the next step toward becoming clients.

Measuring Email Marketing Success

Measuring the success of your email marketing efforts is essential for optimizing your strategy and achieving better results. Use email marketing analytics tools to track key metrics such as open rates, click-through rates (CTR), conversion rates, and unsubscribe rates.

Analyze these metrics to determine which types of content and subject lines resonate most with your audience. Pay attention to engagement patterns, such as the times and days when your emails receive the highest open rates, and adjust your sending schedule accordingly.

Monitor the performance of different email campaigns to identify successful tactics and areas for improvement. Conduct A/B testing on various elements, such as subject lines, email content, and CTAs, to find the most effective combinations.

Additionally, gather feedback from your subscribers through surveys and direct responses to understand their preferences and pain points better. By continually analyzing and refining your email marketing strategy, you can enhance engagement, increase conversions, and grow your credit repair business.

Paid Advertising

Benefits of Paid Advertising for Credit Repair Services

Paid advertising is a powerful tool for promoting your credit repair services and attracting potential clients. One of the primary benefits is the ability to reach a highly targeted audience quickly. Platforms like Facebook and Google allow you to specify demographics, interests, and behaviors, ensuring your ads are seen by individuals most likely to need credit repair services. This targeted approach increases the efficiency of your marketing efforts and maximizes your return on investment (ROI).

Paid advertising also provides measurable results, allowing you to track key metrics such as impressions, clicks, and conversions. This data-driven approach enables you to optimize your campaigns in real-time, adjusting your strategies based on what works best.

Additionally, paid ads can enhance your online presence by driving traffic to your website, increasing brand visibility, and establishing your business as a credible authority in the credit repair industry. By investing in paid advertising, you can generate quality leads, accelerate business growth, and gain a competitive edge in the market.

Creating Effective Facebook Ads

Creating effective Facebook Ads requires a strategic approach to capture the attention of your target audience and drive conversions. Start by defining your campaign objectives, whether it’s to increase brand awareness, generate leads, or drive website traffic. Use Facebook’s detailed targeting options to reach individuals who are most likely to need credit repair services, such as those with specific financial behaviors or interests related to personal finance.

Design visually appealing ad creatives that include clear and compelling messages. Use high-quality images or videos that resonate with your audience, and ensure your ad copy highlights the unique benefits of your credit repair services. Include a strong call-to-action (CTA) that encourages users to take the desired action, such as “Get Your Free Credit Report Review” or “Improve Your Credit Score Today.”

Test different ad formats, such as carousel ads, video ads, and single image ads, to see which performs best. Monitor your ad performance through Facebook Ads Manager, tracking metrics like click-through rates (CTR) and conversion rates to optimize your campaigns. Regularly update your ads to keep the content fresh and relevant, ensuring continuous engagement and improved results.

Utilizing Google Ads for Lead Generation

Utilizing Google Ads for lead generation can significantly enhance your credit repair business’s online visibility and attract potential clients actively searching for credit repair solutions.

Design compelling ad copy that includes these keywords and highlights the unique selling points of your services. Ensure your ads have a strong call-to-action (CTA), such as “Get Your Credit Fixed Today” or “Schedule a Free Consultation.” Use Google’s ad extensions, such as call extensions and site link extensions, to provide additional information and make it easier for potential clients to contact you.

Set up conversion tracking to measure the effectiveness of your ads and optimize your campaigns based on performance data. This includes monitoring metrics such as click-through rates (CTR), cost-per-click (CPC), and conversion rates. Utilize remarketing strategies to re-engage users who have previously visited your website but did not convert. By continuously refining your Google Ads campaigns, you can generate high-quality leads, increase your client base, and grow your credit repair business effectively.

Networking and Partnerships

Partnering with Local Businesses

Partnering with local businesses can significantly enhance your credit repair business by expanding your reach and building a strong referral network. Start by identifying businesses that share a similar client base but are not direct competitors, such as financial planners, tax preparation services, and local banks. Approach these businesses with a proposal for a mutually beneficial partnership. For example, you can offer to refer your clients to their services in exchange for them recommending your credit repair services to their clients.

Collaborate on marketing initiatives like co-hosted workshops, joint promotions, or community events to increase visibility for both parties. Ensure that your partners understand the value of credit repair and how it complements their services, which can enhance their clients’ financial health.

Additionally, providing educational resources and training sessions to your partners’ staff can help them better understand your services and make more informed referrals. By establishing strong partnerships with local businesses, you can create a steady stream of referrals, enhance your business credibility, and foster community trust.

Attending Industry Events and Conferences

Attending industry events and conferences is a valuable strategy for networking, learning, and promoting your credit repair business. These events offer opportunities to connect with industry leaders, potential clients, and other professionals in the credit repair and financial services sectors. Participate in relevant conferences, trade shows, and seminars to stay updated on the latest industry trends, technologies, and regulatory changes.

While attending these events, actively engage in networking activities such as workshops, panel discussions, and social gatherings. Collect contact information, exchange business cards, and follow up with new connections to build lasting professional relationships. Consider setting up a booth or participating as a speaker to showcase your expertise and services. Sharing your knowledge through presentations or panel discussions can position you as a thought leader in the credit repair industry, attracting potential clients and partners.

By being present at industry events and conferences, you not only gain valuable insights but also enhance your business visibility and reputation. This proactive approach can lead to new partnerships, collaborations, and business opportunities, driving growth and success for your credit repair company.

Building Relationships with Real Estate Agents and Mortgage Brokers

Building strong relationships with real estate agents and mortgage brokers is crucial for growing your credit repair business. These professionals frequently encounter clients who need to improve their credit scores to qualify for home loans, making them ideal referral partners. Reach out to local real estate agencies and mortgage brokerage firms to introduce your services and explain how you can help their clients achieve better credit scores, ultimately facilitating smoother transactions for their business.

Offer to provide training sessions or informational seminars for real estate agents and mortgage brokers, educating them on the credit repair process and how it benefits their clients. Provide them with marketing materials, such as brochures and business cards, that they can distribute to clients in need of credit repair services. Establish a referral program that incentivizes these professionals to refer clients to your business, such as a commission-based system or reciprocal referrals.

Regularly update your partners on the progress of referred clients and share success stories to demonstrate the value of your services. By maintaining open communication and delivering consistent results, you can build trust and long-term partnerships with real estate agents and mortgage brokers. These relationships can lead to a steady stream of referrals, enhancing your business’s growth and reputation in the credit repair industry.

Client Referrals and Reviews

Encouraging Satisfied Clients to Refer Others

Encouraging satisfied clients to refer others is a powerful way to grow your credit repair business. Start by providing exceptional service that exceeds client expectations, as happy clients are more likely to recommend your services. After successfully helping a client, ask them directly for referrals. You can also implement a formal referral program that offers incentives, such as discounts on future services or gift cards, to clients who refer new customers.

Make it easy for clients to refer others by providing referral cards, email templates, and social media prompts. Regularly remind clients about your referral program through newsletters and follow-up communications. By creating a positive experience and rewarding clients for their referrals, you can generate a steady stream of new business from satisfied clients.

Collecting and Displaying Client Testimonials

Collecting and displaying client testimonials is essential for building trust and credibility. After successfully assisting a client, request a testimonial highlighting their positive experience and the results they achieved. You can collect testimonials through email requests, follow-up surveys, or direct conversations. Make the process easy by providing a simple form or guidelines on what to include.

Display these testimonials prominently on your website, especially on your homepage and dedicated testimonial page. Include them in marketing materials, such as brochures, social media posts, and email campaigns. Use both written testimonials and video testimonials to add authenticity and appeal. By showcasing genuine client success stories, you can attract potential clients and demonstrate the effectiveness of your credit repair services.

Managing Online Reviews

Managing online reviews is crucial for maintaining your business’s reputation. Monitor review sites like Google, Yelp, and Better Business Bureau regularly to stay informed about client feedback. Respond promptly and professionally to all reviews, thanking clients for positive feedback and addressing any concerns raised in negative reviews. Your responses should demonstrate your commitment to customer satisfaction and willingness to resolve issues.

Encourage satisfied clients to leave positive reviews by sending follow-up emails with direct links to your review profiles. Highlighting positive reviews on your website and social media platforms can also enhance your online reputation. By actively managing your online reviews, you can build trust with potential clients, improve your business’s credibility, and foster a positive image in the credit repair industry.

Direct Mail Campaigns

Benefits of Direct Mail in the Digital Age

Direct mail remains a valuable marketing tool even in the digital age, offering unique benefits for credit repair businesses. Unlike digital ads, direct mail pieces can physically reach potential clients’ homes, making them harder to ignore and more likely to be noticed. Personalized direct mail campaigns can create a more tangible connection with recipients, enhancing the perception of your brand’s credibility and trustworthiness.

Direct mail also offers high targeting accuracy, allowing you to reach specific demographics and geographic areas that are more likely to need credit repair services. Additionally, direct mail can complement your digital marketing efforts by driving traffic to your website and social media platforms through QR codes or personalized URLs. By integrating direct mail with your overall marketing strategy, you can achieve a balanced approach that increases visibility and generates quality leads.

Designing Effective Mailers

Designing effective mailers is crucial for capturing the attention of potential clients and conveying your message clearly. Start with a compelling headline that addresses a common credit issue or benefit, such as “Improve Your Credit Score Today” or “Get Approved for Your Dream Home.” Use high-quality images and a clean layout to make your mailer visually appealing and easy to read.

Include a clear call-to-action (CTA) that prompts recipients to contact you, visit your website, or schedule a free consultation. Offer incentives, such as a free credit report review or a discount on your services, to encourage immediate response. Personalize the mailer with the recipient’s name and relevant information to make it more engaging.

Ensure all essential information, like your contact details and business credentials, is prominently displayed. A well-designed mailer can effectively communicate the value of your credit repair services and motivate recipients to take action.

Tracking the Success of Direct Mail Campaigns

Tracking the success of direct mail campaigns is essential for measuring their effectiveness and optimizing future efforts. Start by including unique tracking mechanisms in your mailers, such as personalized URLs (PURLs), QR codes, or specific phone numbers for recipients to use when responding. These tools allow you to monitor responses and gather data on how recipients interact with your campaign.

Analyze key metrics such as response rate, conversion rate, and return on investment (ROI). Compare the performance of different mailer designs, offers, and targeting strategies to identify what works best. Additionally, follow up with recipients who responded to your mailer to understand their motivations and feedback. By continuously tracking and analyzing your direct mail campaigns, you can refine your approach, improve engagement, and maximize the impact of your marketing efforts.

SMS Marketing

Benefits of SMS Marketing for Credit Repair Businesses

SMS marketing offers numerous benefits for credit repair businesses. One of the primary advantages is its high open rate; SMS messages are typically opened within minutes, ensuring your message reaches potential clients quickly. This immediacy makes SMS marketing an excellent tool for time-sensitive offers and reminders. Additionally, SMS marketing allows for direct and personalized communication with clients, fostering a more intimate and trusted relationship.

With SMS marketing, you can easily segment your audience and send targeted messages based on their specific needs and behaviors, such as reminders about upcoming consultations or tips for improving their credit scores. It’s also a cost-effective marketing strategy, with relatively low costs compared to other forms of advertising, while delivering high engagement rates. Overall, SMS marketing can enhance client engagement, drive conversions, and support the growth of your credit repair business.

Crafting Compelling SMS Messages

Crafting compelling SMS messages involves being concise, clear, and engaging to capture your audience’s attention within the 160-character limit. Start with a strong and relevant hook to draw the recipient in, such as “Boost Your Credit Score Today!” or “Limited Time Offer: Free Credit Report Review.” Personalize the message by including the recipient’s name and addressing their specific needs or concerns.

Include a clear call-to-action (CTA) that prompts immediate response, such as “Call us now,” “Reply YES to start,” or “Visit [your website].” Use urgency and exclusivity to encourage quick action, like “Offer ends soon” or “Only 5 spots left.” Ensure the message provides value, whether it’s through a special offer, useful tip, or important update. By keeping your messages direct and actionable, you can effectively engage your audience and drive them to take the desired steps.

Ensuring Compliance with Federal Laws

Ensuring compliance with federal laws is crucial for the legal and ethical use of SMS marketing. The Telephone Consumer Protection Act (TCPA) regulates SMS marketing, requiring businesses to obtain explicit consent from recipients before sending promotional messages. This means you must have a clear opt-in process where clients willingly provide their phone numbers and agree to receive texts from your business.

Make sure your messages include an opt-out option, such as replying “STOP” to unsubscribe, to allow recipients to withdraw their consent easily. Maintain accurate records of all consents and opt-outs to demonstrate compliance if needed. Additionally, ensure that your messages are not sent during inappropriate hours, typically between 9 PM and 8 AM local time of the recipient. By adhering to these regulations, you protect your business from potential legal issues and build trust with your clients through respectful and compliant communication practices.

Utilizing Credit Repair Software

Advantages of Credit Repair Software

Credit repair software offers numerous advantages for streamlining and enhancing the operations of a credit repair business. It automates many time-consuming tasks such as tracking client progress, generating dispute letters, and managing client communication, which increases efficiency and reduces manual errors. This automation allows you to handle more clients effectively and improves overall productivity.

Additionally, credit repair software provides valuable analytics and reporting features that help you monitor the success of your credit repair strategies. It also ensures compliance with industry regulations by maintaining accurate records and documentation of all activities.

The centralized management of client data enhances organization and accessibility, allowing you to provide personalized and responsive service. Overall, using credit repair software can significantly improve operational efficiency, client satisfaction, and business growth.

Popular Credit Repair Software Options

Several popular credit repair software options can help streamline your business processes. Credit Repair Cloud is widely used for its comprehensive features, including client management, automated dispute processing, and integration with credit monitoring services. It also offers training and support to help you get the most out of the software.

DisputeBee is another option that focuses on simplicity and ease of use, making it ideal for smaller businesses or those new to credit repair. It provides templates for dispute letters and a user-friendly interface for managing client cases.

ScoreCEO offers robust automation and workflow management features, allowing you to handle multiple clients efficiently. It includes tools for compliance management, reporting, and client communication, ensuring a smooth and professional operation. Choosing the right software depends on your specific needs and the scale of your business, but these options are all excellent starting points.

Integrating Software into Your Business Process

Integrating credit repair software into your business process involves a few key steps to ensure a smooth transition and optimal use. Start by selecting software that meets your business needs and budget. Once chosen, import your client data into the new system, ensuring all information is accurate and up-to-date.

Train your team on how to use the software effectively, including understanding its features and capabilities. Many software providers offer tutorials, webinars, and customer support to assist with this process. Implement the software gradually, beginning with core functions such as client management and dispute processing, then expanding to advanced features like automated communication and analytics.

Regularly review and adjust your workflows to align with the capabilities of the software, ensuring you leverage its full potential. By integrating credit repair software effectively, you can enhance efficiency, improve client satisfaction, and drive business growth.

Monitoring Client Progress

Regularly Reviewing Client’s Credit Reports

Regularly reviewing clients’ credit reports is essential for tracking their progress and identifying any changes or inaccuracies that need to be addressed. Schedule periodic reviews, such as monthly or quarterly, to ensure you stay updated on each client’s credit status. During these reviews, compare the current reports with previous ones to assess improvements or new issues.

Look for changes in credit scores, the status of disputed items, and any new negative information that might have appeared. Use credit repair software to automate and streamline this review process, ensuring that no detail is overlooked. By consistently monitoring your clients’ credit reports, you can provide timely interventions and maintain a proactive approach to credit repair, enhancing the effectiveness of your services.

Updating Clients on Their Progress

Keeping clients informed about their progress is crucial for maintaining transparency and building trust. Regular updates reassure clients that their cases are being actively managed and that they are making progress toward their credit repair goals. Use automated email systems or your credit repair software to send monthly or bi-weekly progress reports.

These reports should include changes in credit scores, updates on disputed items, and any actions taken on their behalf. Personalize the updates to address specific client concerns and achievements, highlighting significant improvements or milestones reached. By consistently communicating progress, you enhance client satisfaction and engagement, fostering long-term relationships and positive referrals.

Adjusting Strategies Based on Client Feedback

Adjusting your credit repair strategies based on client feedback is essential for delivering personalized and effective services. Actively seek feedback through regular check-ins, surveys, or direct communication to understand clients’ experiences and concerns. Analyze this feedback to identify areas for improvement and adapt your strategies accordingly.

For example, if clients express confusion about the dispute process, provide additional educational resources or more detailed explanations in your communications. If clients are not seeing expected results, reassess their cases to identify alternative approaches or additional actions that can be taken. By being responsive to client feedback and continually refining your strategies, you can improve service quality, achieve better outcomes, and enhance client satisfaction.

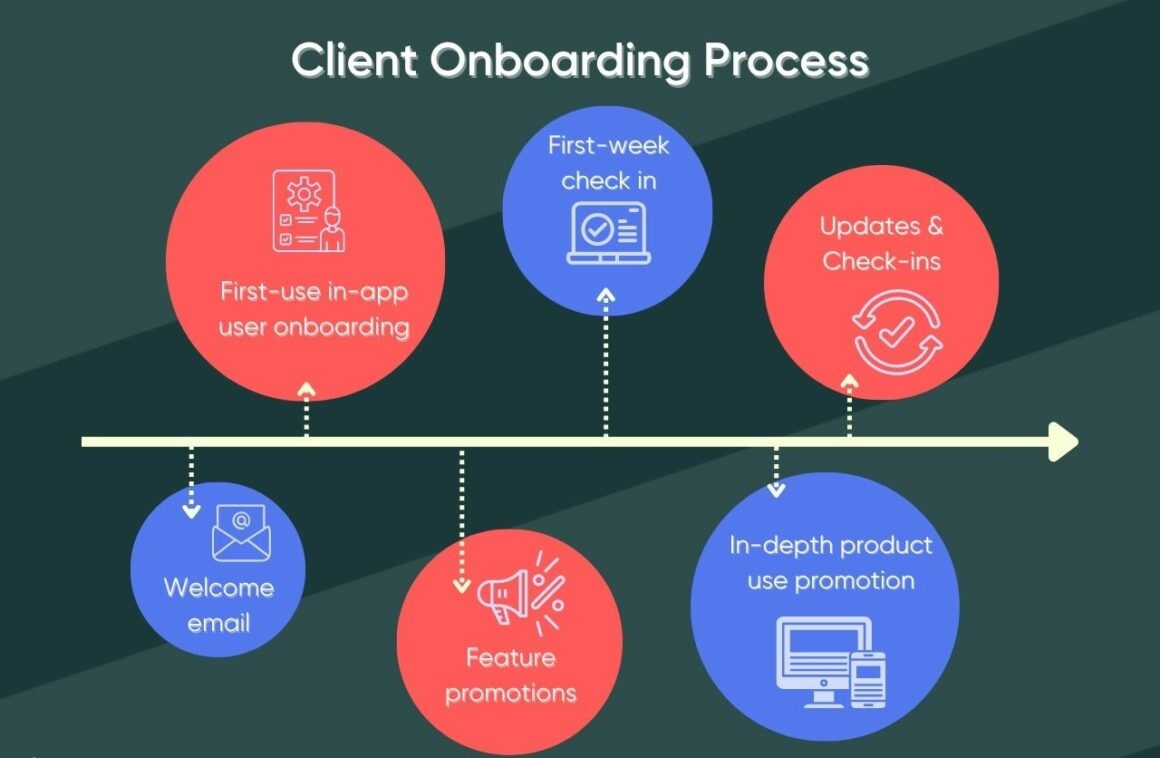

Creating a Client Onboarding Process

Initial Consultations and Assessments

Initial consultations and assessments are critical steps in the client onboarding process for your credit repair business. Begin by offering a free consultation to understand the client’s specific credit issues and financial goals. During this session, gather detailed information about their credit history, including current credit reports, scores, and any recent credit-related incidents.

Use this data to perform a thorough assessment, identifying inaccuracies, negative items, and areas needing improvement. This comprehensive evaluation allows you to create a personalized credit repair plan tailored to the client’s unique situation, setting the stage for successful outcomes and building trust from the outset.

Setting Realistic Expectations

Setting realistic expectations is essential for maintaining client satisfaction and trust throughout the credit repair process. During the initial consultation, clearly explain the steps involved in credit repair, the time it typically takes, and potential outcomes. Emphasize that while some improvements can happen relatively quickly, comprehensive credit repair is often a gradual process that may take several months.

Be transparent about the factors that influence the timeline, such as the nature of the inaccuracies and the responses from credit bureaus and creditors. By providing a realistic overview of the process and possible results, you help clients understand what to expect and reduce the likelihood of frustration or dissatisfaction.

Providing a Roadmap for Clients

Providing a clear and detailed roadmap for clients is vital for guiding them through the credit repair process. After the initial consultation and assessment, create a customized action plan that outlines the specific steps you will take to address their credit issues. Include a timeline with key milestones and expected dates for dispute submissions, follow-ups, and progress reviews.

Share this roadmap with your clients, ensuring they understand each phase and their role in the process, such as providing additional documentation or staying informed about their credit reports. A well-structured roadmap not only keeps clients informed and engaged but also demonstrates your commitment to their success, fostering a collaborative and transparent relationship.