A loan modification is a change made to the terms of an existing mortgage, usually intended to make the loan more manageable for borrowers who are experiencing financial difficulties.

By altering aspects like the interest rate, loan duration, or monthly payment amounts, modifications aim to reduce the financial burden on the borrower. This process can be a vital tool for those at risk of defaulting on their mortgage, potentially allowing them to maintain their credit score and keep their home.

Understanding how these changes affect your credit is essential for making informed financial decisions, especially when negotiating the terms of a modification with your lender.

The Basics of Loan Modification

A mortgage loan modification involves altering the original terms of your loan to make the monthly payments more affordable. These changes can include extending the loan term, reducing the interest rate, or even changing from a variable rate to a fixed rate.

The primary purpose of loan modifications is to help borrowers who are struggling to meet their mortgage obligations due to financial hardships, thereby helping them avoid foreclosure. By modifying the loan, lenders aim to achieve a payment structure that the borrower can manage, ensuring continued payment and avoiding the loss of the home.

Types of Loan Modifications

Loan modification programs can vary widely but typically involve some combination of reducing monthly payments, altering interest rates, or extending the loan term. Common types include creating a new loan that consolidates past due balances with the original mortgage amount, thus forming a new mortgage, or simply modifying the existing loan’s terms.

During a forbearance period, lenders may also temporarily pause or reduce mortgage payments, offering borrowers time to improve their financial situations. Following forbearance, a repayment plan is often instituted to catch up on missed payments. Each of these modifications aims to make repayment more feasible and prevent the severe consequences of foreclosure.

How Loan Modifications Work?

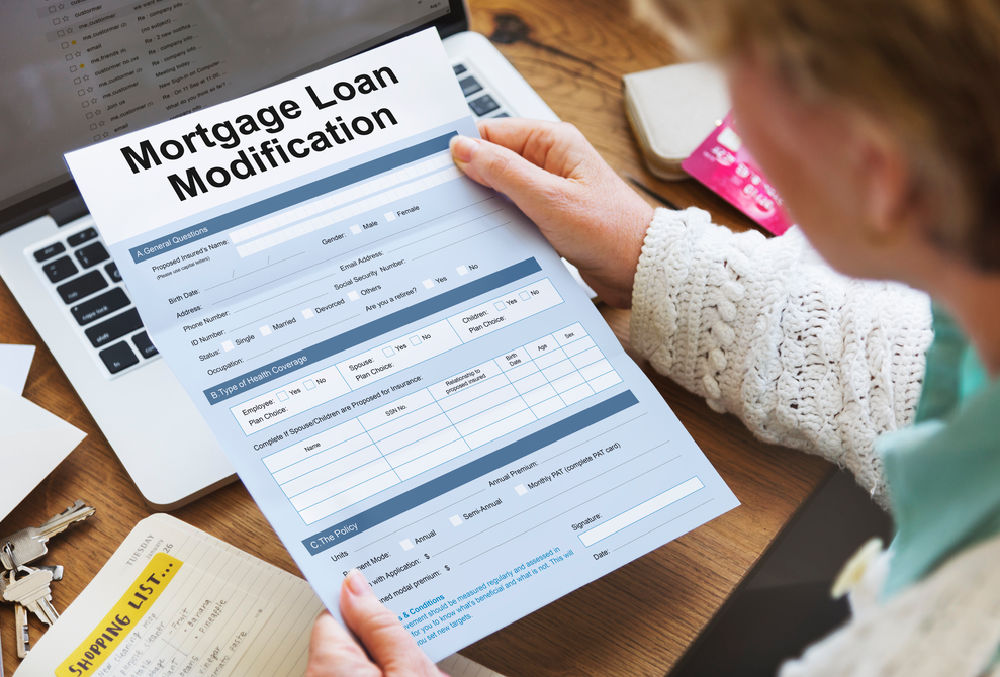

Obtaining a loan modification involves several key steps, primarily centered around negotiation and agreement with your mortgage lender. Initially, a borrower who is facing financial difficulties needs to contact their mortgage lender to express the need for modification of their loan terms.

Documentation proving financial hardship, such as income statements and expense accounts, must be submitted. The lender then evaluates these documents to decide if the borrower qualifies for a modification and what type of adjustment would make the loan sustainable. The steps include assessment, negotiation, and finalization of the new loan agreement.

This process not only requires cooperation between the borrower and the lender but also needs the lender to report any changes to the loan agreement properly, ensuring that all modifications are legally binding and financially feasible.

The Impact on Credit Scores

The impact of a loan modification on a borrower’s credit score can be immediate and long-term. Initially, if a loan modification involves any reporting of missed payments or changes in loan structure, it could be recorded on a credit report and potentially negatively impact the borrower’s credit score.

Credit bureaus receive reports regarding any alterations in loan terms, which may reflect as a financial instability marker in the short term. However, if the modification leads to more manageable monthly payments, it allows the borrower to maintain consistent payment histories moving forward. This positive change can stabilize and potentially improve a borrower’s credit history over time.

Effectively, while there may be an initial dip in credit scores due to the reporting of the modification, the long-term effect could be beneficial as it helps in preventing more severe outcomes like foreclosure, which would have a more detrimental impact on credit.

Key Factors Influencing Credit Impact

Several factors can influence the impact of a loan modification on your credit score, with monthly payments and their reporting being central. When a loan modification is agreed upon, the lender outlines a new payment plan. These monthly payments are typically lower than the original payments, making it easier for the borrower to manage.

However, the way these payments are reported to credit bureaus can affect the borrower’s credit. If the modification includes a forbearance period, where payments are paused or reduced temporarily, it is crucial that this is properly documented and communicated to credit bureaus. Missed payments prior to the modification can also impact the credit score negatively.

These payments, if not officially recognized under the modified loan terms, may appear as delinquencies on a credit report. Therefore, clear and timely reporting by the lender is essential to mitigate any negative effects on credit.

Specific Loan Modification Scenarios

Loan modifications can be prompted by various scenarios, each with unique implications for borrowers and lenders. A common scenario is significant financial hardship, where a borrower may face sudden unemployment or medical bills, prompting the need for more manageable payment terms.

Another scenario could involve a natural disaster, leading to temporary or permanent loss of property use and income, necessitating modifications to mortgage terms. In such cases, lenders might adjust the loan terms to reflect the reduced income, thereby preventing default.

These modifications, while helpful in the short term, require careful management to ensure they do not lead to longer-term financial difficulties for the borrower. Each scenario demands a tailored approach to effectively assist the borrower while maintaining the integrity of the credit system.

Legal Considerations and Rights

Under the Fair Credit Reporting Act (FCRA), borrowers have specific rights that protect their credit information during financial activities like loan modifications. This act ensures that any information provided to credit bureaus is accurate, and it gives borrowers the right to dispute inaccuracies on their credit reports.

When a credit report is pulled by a lender for the purpose of a loan modification, the FCRA mandates that this action must be done with the borrower’s consent and handled with confidentiality. Awareness of these rights is crucial for borrowers as they navigate the implications of loan modifications on their credit reports.

Best Practices

Understanding the impact of loan modifications on your credit score is essential for making informed financial decisions. Whether facing significant financial hardship or seeking to avoid foreclosure, it’s important to explore all available loan modification options.

Borrowers should strive to maintain open communication with their lenders, ensure accurate reporting to credit bureaus, and make use of legal rights provided under the Fair Credit Reporting Act. By adhering to these practices, borrowers can manage their modified loan terms effectively and minimize negative impacts on their credit score.

Understanding the Loan Modification Process

The Initial Steps to a Loan Modification

The loan modification process begins when a borrower experiences financial difficulty and reaches out to their lender. The first step typically involves reviewing the original loan agreement to determine how terms can be adjusted to better suit the borrower’s current financial situation.

During this phase, the lender assesses the borrower’s financial documentation and may decide to offer a modification that alters the loan balance, mortgage payments, or loan payments structure. This initial interaction is crucial as it sets the groundwork for potential changes in the loan terms.

Lender Evaluation and Agreement

Once the initial review is completed, the lender reports their findings and suggests options for modifying the loan. If the lender agrees to modify the terms, a new agreement outlining the changes—including any alteration to the repayment period or adjustment to the loan payments—is drafted.

This agreement is vital as it formally documents the modifications and ensures both parties are clear about the new terms. It’s important for borrowers to understand that any missed payment or even the first missed payment under the new terms could still impact their credit standing.

Impact of Loan Modifications on Financial Stability

Balancing Loan Payments and Financial Health

A well-negotiated loan modification can provide relief by reducing the monthly financial burden, potentially preventing severe outcomes like debt settlement or foreclosure. By adjusting the mortgage loan payments to a more manageable level, borrowers can maintain their homes and slowly rebuild their financial stability. This careful balancing act is crucial in overcoming long term financial hardship and securing financial health.

Credit Reporting and Long-Term Implications

When a credit report is pulled by the lender during the modification process, it’s done to assess the borrower’s current financial status. The way these modifications are reported to the credit bureau can have a lasting impact on the borrower’s credit profile.

It’s essential for borrowers to monitor their credit reports following a modification to ensure that all information is reported accurately and to dispute any discrepancies that might arise.